Barely 18 years after the national carrier exited, Uganda Airlines has made a return to the skies in a notoriously fickle industry.

Beyond protectionist policies and low volumes of passengers that afflict many national carriers in Africa, Uganda Airlines Corporation (UAC) will have to shake off a chequered history peppered with deep-seated institutional malaise, incompetence and interference from regime cronies that led to its collapse.

This is largely what the Special House Committee sanctioned to probe the privatisation of a number of government parastatals in 1999 summed up as “a few but politically- powerful people sacrificed the citizens’ interest to manipulate and take advantage of the privatisation process.”

Rummaging through the airlines history buried in the heap of scripts, perhaps lie answers to what happened to the airline before it collapsed.

For example, UAC was technically bankrupt to the tune of $11m (Shs41b), its books of account had not been audited since 1994, it suffered severe losses of its market share on all routes and the brand of the company had been immensely damaged by mismanagement and corruption.

However, several observers have opined that the last nail, which actually came first, in UAC’s coffin was the creaming off of its lucrative ground handling business—the Uganda Airlines and Entebbe Handling Services (ENHAS).

Besides the opaque sale of the airlines assets, was the death of Davis Joash Mugizi, a former commercial service manager.

Mugizi had appeared before the special committee where he provided valuable information on the mismanagement of Uganda Airlines before its collapse.

“He came back after that and pleaded with the committee and said guys, I am going to be killed. The guy pleaded, the guy came crying. He said I am going to be killed. I am going to be killed for what I have told you,” Ms Salaamu Musumba, a member of the committee, who represented Bugabula South in the Sixth Parliament, recalled.

Witness killed

On June 1, 2000, Mugizi was killed in Bunga, a Kampala suburb, barely seven months after Parliament debated the committee report.

Five Sudanese were later charged in the High Court for his murder.

The suspects were freed in 2003, re-arrested and later regained their freedom.

Mugizi was among the technocrats who served at the time the winds of privatisation propelled by the Washington consensus— the World Bank and the International Monetary Fund—were sweeping across the country.

Besides UAC, a dozen other parastatals such as Uganda Commercial Bank (UCB) were dismantled and others sold for a pittance.

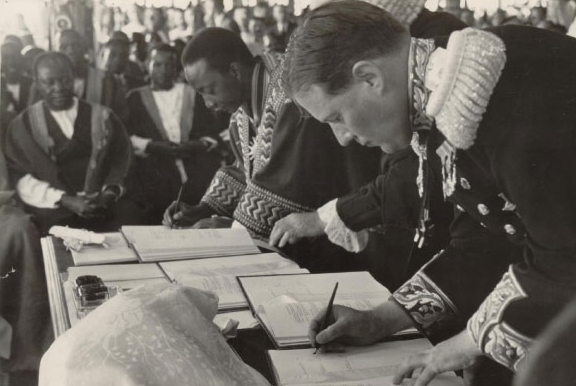

On November 2, 1999, the special committee chaired by the late Aisu Omongole, the former Kumi MP, tabled its report before the plenary.

Parliament heard that at the time of privatising UAC, there was almost nothing to sell apart from two old planes. The committee report revealed that in November 23, 1993, the Civil Aviation Authority had invited inquiries in Public Notice. Services listed included, among others, aircraft, cargo and passenger handling which were being provided by UAC.

“Most often, members well placed in this regime (NRM) and in past regimes, were using this place. They would use it for their private errands without paying for the plane,” the report read in part.

The House committee questioned how Efforte, a company owned by Gen Salim Saleh, President Museveni’s younger brother, and an Israeli national Hezi Bezalel, Kenbe Investments Limited owned by Mr William Byaruhanga and Mr Charles Mbiire were part of the consortium that took over UAC’s inflight catering services without fair competition.

Mr Byaruhanga is currently the Attorney General and Mr Mbiire is a prominent businessman.

However, the probe discovered that the owners of Kenbe Investment later sold 999 shares of their company to Saleh’s Efforte and the remaining share was sold to Must Win Corporation Limited.

Gen Saleh’s company, later in partnership with Global Airlinks Company, owned by now Foreign Affairs minister Sam Kutesa, took over ENHAS.

Kutesa woes

Mr Kutesa, who was the State minister for Finance, Planning and Investment at the time, in his earlier address to Parliament in December 1998 denied any wrongdoing.

“I am both chairman of ENHAS and also a minister of State for Finance. There maybe a feeling that these two positions may constitute or would probably constitute a conflict of interest,” he said.

“In my own opinion, I have regarded ENHAS as a private limited liability company and I have regarded it so not withstanding that Uganda Airlines was a 50 per cent shareholder, my view was that it was an investment where a company called Uganda Airlines Corporations invested its funds, just like my company invested, and I thought in my view that there would be no conflict of interest because I believe honourable members here still chair companies or are directors in companies but sometimes do business with government,” Mr Kutesa added.

He was later censured in 1999 for abuse of office and influence peddling over the acquisition of the cargo ground handling service.

Mr Jackson Jurua, the former UAC’s commercial manager, said ground handling is “a cash cow of airlines” world over and in Uganda Airline’s case, as losses increased, the airline’s passenger operations were run by money made from ground handling.

“The airline was not generating enough revenues, and without a subsidy from government, it could not survive,” Mr Jurua, who departed UAC in the mid-1990s, recounted.

He also revealed that profitability for the airline’s passenger operations waned further after it stopped long haul flights to Europe and Middle East after its Boeing 707-338c, used for long haul flights, crashed in Rome in 1988.

Ms Musumba told this newspaper that government’s intention to sell the airline had more to do with whitewashing the legacy of former presidents Amin and Obote.

“There was only one option; get rid of Uganda Airlines. They (government) were not serious about the options he [Manzi Tumubweine] said. They just wanted to break down everything and begin a new narrative; to loot, share and flee,” she said.

Mr Tumubweine was by then the State minister for Privatisation.

He recounted to this newspaper that he tried to warn against the sale to South African Airways (SAA) and Alliance Air (AA) on the premise that SAA/AA was taking UAC very cheapily given its many liabilities.

“The question was that UAC was making losses but at that same time, three airlines in the United States were making heavy losses. I tried to make a case for Uganda Airlines and Uganda Commercial Bank (another parastatal which was schemed off through privatisation) but I lost,” Mr Tumubweine said.

He added: “That is when I gave the option of selling it to the South Africans: liquidate it, and kill it off, or recapitalise it.”

In hindsight, after the subsequent events, Mr Tumubweine said “the airline like in our case was not about whether it was making money or not but whether it could make a second tier of other aspects of the economy.”

When 49 per cent shares of UAC were put up for sale to form a strategic equity partnership in March 1998, among those that expressed interest included Sabena Airways, British Airways, South Africa’s Alliance Air, Kenya Airways and Air Mauritius.

All bidders but Kenya Airways were prequalified on grounds that it could not create another regional hub at Entebbe when it already has Nairobi.

The prequalification stage then hit snag as UAC’s sellers and potential buyers fought over the airline’s route rights.

HSBC Equator Bank, the transactional adviser to government’s Privatisation Unit (PU), contended that UAC could not attract good buyers because the Africa Joint Air Services (AJAS) agreements which it was part of had given its lucrative routes to Alliance Air.

AJAS was the agreement signed in the early 1990s by Uganda, Zambia and Tanzania for operating a joint airline.

One of the sticky issues was the ownership of route rights. The attorney general advised that the route rights are a property of the State not necessarily the airline.

The House committee, which had been formed to look into ways of furthering the sale of UAC, gave a green light to the Privatisation Unit in the Finance ministry to fast-track the tendering process by April 30, 1999.

The tendering process hit a brick wall after all bidders but the consortium of SAA/AA pulled out.

This meant that government had to go into direct negotiations with SAA/AA. However, it emerged that the consortium had conducted its own due diligence into the health of UAC and established that some of the information provided by government was false.

SAA/AA also demanded, among others, that for Uganda Airlines to operate successfully, if acquired, government needed to change the designator code (the two-character code assigned by the association of the world’s airlines) to SAA to enable it enjoy a wide range of economies of scale associated with airlines with global alliances.

The other contentious issues were the question of the sale of the 51 per cent shares that government owned in UAC as there was no other interested buyer, and SAA was also not comfortable inheriting some of UAC’s aircrafts like the Boeing 737-500, which had been leased from Australia that SAA/AA slammed as a poorly negotiated deal.

In December 1999, President Museveni met a delegation from SAA/AA in an attempt to iron out some of the sticky issues in the way of the acquisition of UAC.

Terms

Some of the terms of the proposed deal were that the rebranded carrier would carry the QU and SA codes designator codes concurrently, and government would retain the chair of the privatised entity –of which SAA/AA would own a 49 per cent stake—for the first year, with a casting vote, while UAC’s many liabilities would be catered for outside the partnership.

Months later in April 2000, SAA backed out of the deal on grounds that the government’s bureaucracy had affected the value of UAC.

SAA’s executive president William Meaney was quoted at the time as saying that they took the decision after commercial realities in Uganda changed markedly during nearly a year of talks over its investment plans.

Another consortium organised by former employees of UAC superintended by the company’s former general manager, Mr Ben Mutyaba, had months earlier mobilised themselves under FIN Investments Ltd and offered to pool resources to buy the 51 per cent shares but the deal did not materialise.

UAC commenced operations in 1977 following the collapse of the East African Community (EAC) as a result of the acrimonious politics of the time.

The EAC bloc, then more solid, operated the East African Airways, which had been in existence since 1948 when it was established by the 1947 East Africa Aviation Act enacted by the East African Legislative Assembly as was called then.

The demise of the East African Airways nearly brought travel to a shuddering halt to and out of Uganda, and since a number of airliners such as British Overseas Airways Corporation or British Airways as it is called now, had suspended operations to Entebbe owing to Amin’s disruptive policies.

Consequently, President Amin decreed establishment of UAC on May 17, 1976. UAC was as a result of a merger of Uganda Aviation Service Limited and Uganda Air Limited, as a wholly owned public company.

This was followed by acquisition of several aircrafts, which included two Boeing 707s, a Lockheed C-130 transport plane and a variety of smaller aircrafts.

The smaller aircrafts were specifically used for flights around the country—from Entebbe to Jinja, Kibimba, Arua, Kasese and others.

Amin did live to see much of UAC’s operations blossom as he was ousted a year and a half later but regardless, it remained a national pride in the succeeding years even through turbulent economic times, until it would up operations in May 2001.

New things usually create excitement, and the revival of Uganda Airlines is such but beyond the hoopla, it remains to be seen whether the ghosts from the past will not return to haunt the revived airline.

A330neo Airspace by Airbus. (Runway Girl)