– UGANDA’S HISTORICAL DESPOTIC AND REPRESSIVE EMPIRE COMMANDED BY MUSEVENI –

The BCD’s 7 Commandments – Extinction of Native Ugandans

- THE NATIVES BE DENIED QUALITY EDUCATION.

- THE NATIVES BE DENIED QUALITY HEALTHCARE.

- THE NATIVES BE DENIED FOOD SECURITY.

- NATIVES BE DENIED CIVIL SERVICE, MILITARY, POLICE AND INTELLIGENCE.

- THE NATIVES MUST SUFFER LOSS OF LAND AND PROPERTY.

- THE NATIVES BE KILLED, JAILED AND EXILED.

- THE NATIVES BE IMPOVERISHED.

March 13TH 2006 Meeting.

The opening remark was; –

Corruption in the BCD is not criminal, but a courtesy responsibility to attain the financial wellness or our successors to downcast the poverty of our fore fathers. – By Yoweri Kaguta Museveni, Chairman.

When oil was confirmed in the mid-2000s, the 1993 Rwakitura Covenant 50year Master plan was amended to 100year (Bahima Century Dynasty). The meeting which took place in Rwakitura on March 13th 2006 after the election. The resolutions were: –

- The Corporation with Rwanda be improved and downplay all Kisangani conflicts.

- Make peace with Besigye as long as Winnie Byanyima forever lives out of Uganda.

- Increase the number of districts to decrease political fatigue at the central government as well as expand parliament.

- Bring Amama Mbabazi an immigrant Hutu closer to the piloting deck for the coups he has successfully foiled.

- Hand over regular civilian security to Kale Kayihura and use it to control Kizza Besigye not to go overboard.

- Shift power from the mainstream institutions to projects, authorities and commissions which should be run by biological allies or a trusted social network of BCD.

- The Presidential Guard Brigade should form a special unit to monitor wealth inflow and outflow of individuals who do not belong to the BCD – Bahima Century Dynasty.

- Block and destroy any educated rich Muganda, Northerner or Easterner. Bonny Katatumba should be categorised equally for his monarchical ideas.

- The BCD membership should control all resources in the country.

- Train all our children using the most elite education there is in the world.

- Uphold this current curricular in all government and private schools for the rest of Ugandan to widen the gap between BCD and all the rest.

- Train members of BCD to professionalize oil exploration and trade.

- Acquire all resourceful land in the country and tighten the grip on all resources in the country.

- Do not allow any politician from the opposition to surpass the position preserved for Besigye.

- Do not inter-marry. Hate the northerners, easterners and centrals. Never at any time mix with Muslims. Detest them like faecal matter.

- All public property belongs to Dynasty – BCD.

- Craft all means available at any cost to maintain power in the circles of the Dynasty – BCD.

- The BCD should be encircled by Banyankore, then Bahororo, Bakiga, Tutsi and Hutus.The rest should be workers, drones, slaves and all Muslims invisibles and outcasts.

- Shift some of the investments from the west to China, Russia, Saudi Arabia, Jordan and Kuwait.

- BCD should grow to a level of controlling a number of factors in the entire great lakes region.

- To advance the wealth of BCD, 15% of the National budget should directly be drawn and distributed amongst members of the BCD regardless of their job position or age group as long as one is 18years.

- 50% of the National Budget should be drawn into the BCD membership through contracts, projects, salaries, supplies etc…

- It is in the mandate of the state of Uganda to protect every member of BCD from any sort of crime be it minor, major, capital or international. BCD should keep clean by using proxies to do the dirty work.

- All military power should be under the control of the Dynasty-BCD mainly the president.

- Any potential opposition should be restrained by death.

The leadership is as follows: –

- Chairman – Yoweri Kaguta Museveni.

- Vice Chairman – Sam Kahamba Kutesa.

- General Secretary – Janet Kataha Keinembabazi.

- Assistant General Secretary (Youth) – Molly Asiimwe.

- Secretary for Internal Affairs – Caleb Akandwanaho – Salim Saleh

- Secretary for External Affairs – Violet Kajubiri.

- Secretary for Children Affairs – Natasha Museveni

- Secretary Social Affairs – Chris Kajara.

- Secretary for Security – Elly Tumwine.

- Deputy Secretary for Security – Sabiti Muzeyi.

- Secretary for Investment, Youth Wing – Odrek Rwabogo.

- Secretary for Investment, Corporate Wing – Patrick Bitature.

- Secretary for Overseas Investments – John Kazzora.

- Secretary for Local Investment – Nzeire Kankunda (Toyota)

- Secretary for Political Affairs – George Kashakamba.

- Head of membership Committee – Molly Kamukama.

- Head of Welfare – Allen Kagina.

- Deputy head of Welfare – Seth Rukurungu.

- Head of Local Contracts – John Nasasira.

- Head of Committee for Social Responsibilities and Philanthropy – Kainerugaba Muhoozi.

- Head of Innovations – George William Nkiriho.

- Head of Quest Ideas – Francis Turyamwijuka.

- Head of Supervisory Committee – Chris Rwakakamba.

- Head of Education and Culture Prof. Turyamuhika.

BUSINESSES MONOPOLIES.

- All government contracts – Dynasty, BCD.

- All Supplies to Operation Wealth Creation – Dynasty, BCD.

- All Gorilla tracking permits – Museveni.

- Milk Exportation – Museveni.

- Fish exportation – Museveni.

- Flower exportation – Museveni.

- Dams, Railway and Pipeline – Museveni.

- Road Construction – Museveni and Janet.

- UMEME – Museveni, Janet and Muhoozi.

- Gold Mining – Museveni and Janet Kataha.

- Tiles manufacturing – Museveni and Salim Saleh.

- Uganda Airlines – privately Company owned by Sam Kutesa by law.

- Planned Vehicle assembling – Sam Kutesa.

- Transport for UN especially UNHCR and WFP-Sam Kutesa.

- Water Transportation – Sam Kutesa.

- Air Transport – Sam Kutesa.

- Government motor vehicle procuring – Sam Kutesa.

- Mobile Money Loans – Sam Kutesa and Salim Saleh.

- All petroleum reserves in Uganda – Salim Saleh.

- Petroleum Imports – Salim Saleh.

- All Bajaj motorcycles and spares – Salim Saleh.

- Eskom – Kutesa, Saleh and Kataha.

- UEDCL – Muhoozi.

- All Petroleum Products – Muhoozi K.

- All tyres – Muhoozi and Karugire.

- Uganda Medical Stores – Muhoozi and Diana Museveni.

- Gold refining – Muhoozi, Rwabogo and Karugire.

- All Tiger Head Batteries -Karugire.

- Beef Exportation – Odrek Rwaboogo.

- Airtime printing – Charles Mbiire.

- Mobile Money – Bitature and Janet.

THE BCD EMPIRE-BUSINESSES AND PROPERTIES OWNED BY PROXIES.

A. Y.K MUSEVENI

- 46% of Sudhir’s wealth belong to Museveni in Uganda, East Africa, South Africa, Europe and America.

- 72% of Karim Hirji’s wealth belongs to Museveni with 10% left for Janet Kataha.

- 44% of all Mukwano’s wealth belongs to Museveni.

- 67% of Bidco’s wealth belongs to Museveni.

- 49% of Samona belongs to Museveni.

- 82% of Quality Chemicals belongs to Museveni.

- 70% of Aya Groups belongs to Museveni.

- 100% of J&M Hotel belongs to Both Museveni and Janet Kataha.

- 13% of Exim Bank Shares belong to Museveni ( $8.63bn).

- 41% of Kakira Sugar Works belong to Museveni.

- Pearl dairy Farms Limited belongs to Museveni.

- GBK Group of Companies – Museveni.

B. SALIM SALEH – CALEB AKANDWANAHO

- 66% of Mandela’s wealth belongs to Salim Saleh including City Oils and café Javas.

- 48% of Tata Motors – Salim Saleh.

- 62% of Kinyara Sugar belongs to Salim Saleh

- Mansons Uganda Limited belongs to Salim Saleh.

- 66% of City Oils belongs to Salim Saleh.

- 38% of Eco Bank belongs to Salim Saleh.

- Mogus Oils – Salim Saleh.

- Heritage Coffee Company Ltd – Salim Saleh

- 46% plus 20% of Movit investments belong to Salim Saleh and Muhoozi respectively.

- 42% of all Madhivan’s wealth belongs to Janet Kataha.

- 61% of Patrick Bitature’s wealth belongs to Janet Kataha.

- 71% of Roofings Limited belongs to Janet Kataha.

- 65% of Basajjabalaba’s wealth belongs to Janet Kataha.

- 80% of Simba Telecom – Janet Kataha.

- Garden city – Janet Kataha.

- Golf Course Kampala Hotel – Janet Kataha.

- Rainbow International School – Janet Kataha.

- Protea Hotels East Africa and South Africa belong to Janet and Bitature at 50% each.

- Uganda Air Cargo belongs to Sam Kutesa.

- 37% of Shoprite belongs to Sam Kutesa.

- 91% of Victoria Motors – Sam Kutesa.

- Mestil Hotels belong to Sam Kutesa.

- Oasis Mall belongs to Sam Kutesa.

- Pioneer Transporters – Sam Kutesa.

- Logix technical Solutions – Sam Kutesa.

- 66% of Ham Kiggundu’s wealth belongs to Muhoozi inclusive of all investments in Uganda, UK, USA and South Africa

- 68% of John Bosco’s wealth belongs to Muhoozi including Freedom City.

- 77% of Eagle Air belongs to Muhoozi.

- Skyjet Airlines belong to Muhoozi.

- Orange Telecom – 34% Muhoozi.

- Kampala Jelliton Suppliers – Muhoozi.

- BPC Chemicals Ltd – Muhoozi.

- 41% of Aponyes’ wealth belongs to Muhoozi including Mega Standard Supermarkets.

- 80% of Harris International belongs to Muhoozi and Odrek.

- Acacia Mall belongs to Muhoozi and Kagame with 50% shares each

F – ODREK RWABOGO

- 83% of Autocare – Odrek Rwabogo.

- 65% of Translink Uganda Limited belong to Odrek and Patience.

- 80% of Harris International belongs to Odrek and Muhoozi

- Vehicle and Equipment Leasing – Odrek Rwabogo.

- Future Link technologies – Odrek Rwabogo.

- Picfare Industries – Odrek Rwabogo.

- Tiagong Plastics – Odrek Rwabogo.

- GM Security – Odrek Rwabogo.

- Canada Uganda Recruitment Agency –Odrek Rwabogo.

- ZENCH XIN Electronics – Odrek Rwabogo and Sam Kutesa.

- Elite Computers Limited- Odrek Rwabogo and Frank Tumwebaze at 50% each.

G – NZEIRE KAKUNDA[TOYOTA].

- Sango bay Estates belong to Nzeire.

- 51% 0f Toyota Uganda belongs to Nzeire.

- Shell Ankole Limited – Nzeire.

- Kargo International Ltd – Nzeire.

- Mechtools and Equipment – Nzeire and Nasasira.

- 55% of Drake Lubega’s wealth belongs to Natasha Museveni and Karugire.

- Kazinga Channel Office World – Natasha Museveni

- Homeland Holdings – Natasha Museveni.

- 72% of Seroma Limited belongs to Diana Museveni.

- 61% of Finance Trust Bank belong to Diana Museveni.

- Friends Consult – Diana Museveni.

- 74% of Pride Micro Finance belongs to Patience Museveni.

- Ugafode Micro Finance belongs to Violet Kajubiri.

- Afro-Kai limited belongs to Violet Kajubiri.

- In-line Print Services – Violet Kajubiri.

- Graphic Mutation Ltd – Violet Kajubiri.

- Integrated Security Solutions belongs to Elly Tumwine.

- Haree hardware Uganda Limited – Elly Tumwine.

- Crane Paper bags Ltd – Elly Tumwine.

- Achelis Uganda Ltd – Elly Tumwine.

- Crown Bergers Ltd – Elly Tumwine.

- Prestige Electronics Limited – George Kashakamba

- Blu-Cruise Ltd – John Kazora.

- Balya Stint Hardware – John Kazora.

- Enmarg Group Inc – Molly Kamukama.

- Bwik Petroleum Limited – Molly Kamukama.

- Starlite Engeneers Ltd – John Nasasira.

- Fitzmann Services Ltd – John Nasasira

- African Queen Limited – Joyce Kutesa

- Mola Medical Center – Molly Asiimwe

- Kifaru Chemicals Ltd – Karugire

- Birya United Agencies Ltd – Turyamuhika.

- Prism office supplies – Turyamwijuka.

- Simlaw Seeds Company U ltd – Estel Akandwanaho.

- East African Seeds U Ltd – Caleb Akandwanaho Jr.

- Transpaper Ltd – Chris Rwakakamba

- Fotogenix Ltd – George Nkiriho

- Bemuga Forwarders Ltd – Allen Kagina.

- Atlas Cargo Systems – Allen Kagina

- Security Centre Ltd – Sabiti Muzeyi

- Regal Paints – Kashakamba

- Kenjoy Entreprises Ltd – Joyce Keinembabazi

- 41% Smile Telecom – Bitature.

- Banyankore Kweterana Coop Union – Dynasty, BCD

BCD’S CORRUPTION OF ALL TIMES

- Salim Saleh took over Uganda Railway infrastructure worthy $100m

- Museveni takes over Uganda Dairy Cooperation worthy $400m

- Muhoozi and Karugire take over Nytil worthy $234m

- Salim Saleh, Jovia Saleh franchise DHL using government grant at $220m

- Janet and Museveni take over UCB worthy $1.1bn

- Sam Kutesa takes over Uganda Airlines and airport services worthy $1.3bn

- Salim Saleh takes over Petroleum depots and reserves worthy $768m

- Museveni takes over Kisozi land worthy $100m

- Sam Kutesa and Nasasira connived and plotted the sinking of MV Kabalenga and MV Mwanga with graders and bull dozers worthy $15m which were supposed to be aboard. The truth was that they loaded one grader on each ship and the rest of the machines were loaded on the trucks to Uganda through Mutukula boarder. They sunk the ships and reported a lie that all the cargo was lost. They have blocked all the efforts to retrieve the ships ever since.

- Sam Kutesa rents the government of Uganda two ferries at a cost of Ugx37bn per year for 40years with a sealed contract.

- Sam Kutesa gets Pioneer buses at a cost of Ugx16bn grant from government.

- Janet gets Ugx169bn from Basajjabalaba market compensation.

- Janet, Muhoozi and Saleh get $600m worthy of Uganda telecom shares.

- BCD gets a total of $21bn from plundering DR Congo.

- Museveni and Kutesa earn a bribe of $5bn in oil deals

- BCD earns Ugx110bn per month from courtesy collections from all ministries, government agencies and parastatals.

- Museveni and Salim Saleh earned $4.1bn from the war that led to the independence of South Sudan.

- Janet earns $13m every month from refugees from South Sudan and $7.2m from refugees from DR Congo

- Janet earns $12m every year from the funds used to fight HIV /AIDS.

- Muhoozi earns $22m in procurement of drugs for National Medical Stores.

- BCD earns Ugx400bn from the road fund in UNRA every year.

- URA makes a courtesy contribution of $100m every year to BCD account in the Swiss bank.

- BCD supplies food and cloth to prisons, police, military, government schools, and health centres.

- Muhoozi, Rwabogo and Tumwebaze procured an old faulty Cancer machine from Romania making loot of $11m.

- Muhoozi stole $110m from the ID project under a non-existing Germany company.

- Muhoozi embezzled Ugx113bn from Katosi road project.

- Odrek Rwabwogo and Tumwebaze acquire USAFI land for Ugx37bn making loot of Ugx30bn.

- BCD has grabbed land in the Albertine region and Bunyoro to own 10% of all the oil revenues meaning that BCD will passively earn $1.6bn every year from the petroleum fund.

- Museveni and Saleh earned $280m from partitioning Lake Victoria and allocating it to investors.

- Janet earns $24m from illegal gold mining in Karamoja and Mubende.

- All the money invested in the return of Uganda Airlines amounting to $3bn legally belongs to Kutesa and Museveni.

- 7% of all mobile money transactions charges across all networks go to the BCD making for them $342m annually.

- Every foreign company has to bribe the BCD $0.5m to $3m to operate in Uganda.

- Museveni and Saleh earn $11m per month in AMISOM operations in Somalia

- The proposed Kampala-Jinja Highway costing $1.2bn to start in

- May 2019 has been inflated by $300m or Ugx1.1trn to contribute to NRM/ Museveni 2020/21 presidential campaigns

- The proposed hospital in Lubowa to cost Ugx1.3trn loan by government to an investor has also been inflated by Ugx500bn in the bid to raise campaign money. This comes after NRM sponsors from UK and USA communicating in advance that they will not provide any funding to Museveni in 2020/21 polls.

- BCD anticipate getting a commission of $2bn in the construction of an oil refinery in Uganda.

- BCD anticipate earning $780m from the construction of the pipeline from South Sudan to Tanzania and Kenya.

- Kutesa issued Ugandan Passports to Nicholas Maduro’s family, relatives and cronies at a cost of $20m.

- On 10th March 2019, the UPDF cargo planes landed in Entebbe carrying 15tonnes of refined gold belonging to Nicholas Maduro.

Okusaba kwabanyarwanda ettaka lya Buganda.

More details coming…. All businesses and properties both local and foreign.

The current minister of finance, Mr Matia Kasaija

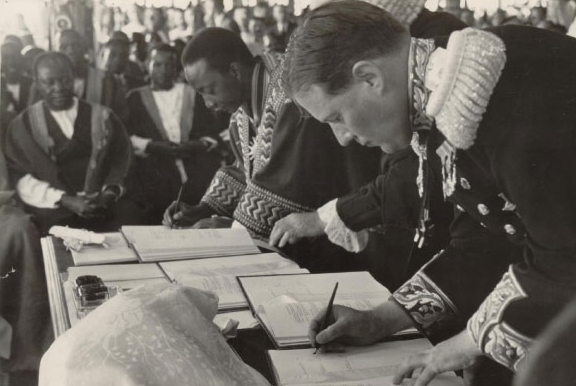

The current minister of finance, Mr Matia Kasaija The Kabaka of Buganda Ronald Muwenda Mutebi II of Buganda stands under a shelter during his enthronement ceremony in 1993

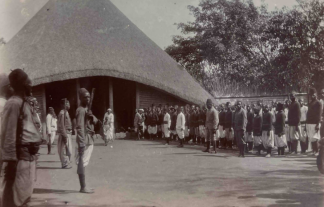

The Kabaka of Buganda Ronald Muwenda Mutebi II of Buganda stands under a shelter during his enthronement ceremony in 1993 One of the Acient geographical maps of the State Kingdom of Buganda around the year 1910

One of the Acient geographical maps of the State Kingdom of Buganda around the year 1910